Brandon Esianor, a third-year student at the University of Texas Health Science Center at Houston, is passionate about practicing medicine one day, but the roughly $140,000 in student debt he expects to owe at graduation is never far from mind. “I frequently find myself thinking about the amount of debt I am acquiring and how it will affect me in the long term.”

Worry over six-figure school debt is part of life for many medical students and young physicians. But a medical career remains “an excellent investment,” said Julie Fresne, MS, director of the AAMC’s office of student financial services. To ease the burden, there are income-based repayment plans, debt-reduction programs, and other financial strategies to make debt manageable, she said.

“There is a concern that the cost of medical school will deter otherwise qualified and underrepresented candidates. We’ve got to get to people younger, earlier; we’ve got to help them understand that they can afford a career in medicine.”

Julie Fresne, MS

Association of American Medical Colleges

That may come as a relief to those students and young physicians stressed by tight finances. “When I start residency, I'll have to look at the options, but I'm hoping loan forgiveness will be around as I'll probably leave with close to $250,000 in debt,” said Aaron Parzuchowski, a fourth-year Johns Hopkins University School of Medicine student who will complete an MPH in his fifth year and seek an internal medicine residency. “As a first-generation college student from a family of very modest means, it's crushing.”

The consequences of overwhelming debt can be dire for anyone, regardless of profession. A study by Julie Phillips, MD, MPH, published in 2016 in the Journal of the American Board of Family Medicine, noted that high debt has been “correlated with callousness, stress, suicidal thoughts, failing medical licensing exams, and leaving or being dismissed from medical school.”

Individual medical schools and the AAMC are focused on the student debt issue, supporting favorable repayment options and regulations. The AAMC offers financial information and tools for medical school applicants, students, and residents through its FIRST program. At the school level, students are offered personal-finance education and counseling.

“Anyone who graduates and gets a residency will be able to repay their debt,” said Casey Wiley, senior assistant director of financial aid and student records at the University of South Carolina School of Medicine Greenville. Wiley oversees financial education programs to make debt repayment quicker and easier, including a budgeting workshop and, for borrowers, a required one-on-one financial planning session once a year. He’s also hosted a class on cooking frugally.

Where there’s a will

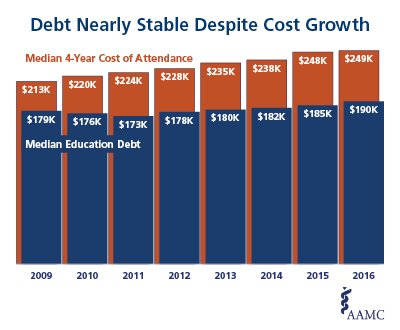

In 2016 nearly 74% of new medical school graduates had education debt. The AAMC annual survey of medical school students also found that median education debt levels for graduates rose to $190,000 in 2016 from $125,372 in 2000, after being adjusted for inflation in constant 2016 dollars.

The figure is high, but, said Fresne, “Strong job security and excellent income potential should enable any medical school graduate—practicing in any specialty—to both repay education debt and have a secure living and retirement.” In recent years debt has increased at only slightly above inflation.

At Harvard Medical School—which provides a “vigorous loan counseling and financial literacy program” and need-based scholarships—about 13% of 2016 graduating students reported that their debt “did somewhat influence their career decisions,” said Stephanie Hunt, the school’s financial aid director.

Still, a 2013 study led by Jay Youngclaus, an AAMC senior research analyst, found that despite growing debt levels, physicians in all specialties could repay loans without incurring more debt.

The Public Service Loan Forgiveness program grants relief on certain loan balances after 10 years of work in public service. The first forgiveness of loan balances will occur in October 2017; however, the future of the program is uncertain. In addition federal and state repayment programs can help borrowers by paying down their student loan debt in exchange for practicing in an underserved area. There are also income-driven repayment plans, such as the Pay As You Earn, that set monthly payments equal to 10% of the borrower’s discretionary income.

It also found that graduates pursuing primary care with higher debt levels needed to consider additional strategies to support repayment, including extended repayment terms, use of a federal loan forgiveness/repayment program, and not living in areas with the highest cost of living.

Typically, physicians benefit from their involvement in public service, the military, or work at government health facilities, Youngclaus added. James Rohlfing, MD, an Oregon Health and Science University graduate and first-year family medicine resident at Ventura County Medical Center in California, joined the U.S. Army. The army pays a stipend during residency and has a repayment program based on time served, up to $250,000.

Student medical debt feeds into concerns about the nation’s health care system, too. With the number of new primary care physicians and doctors in certain specialties not keeping pace with demand, the AAMC projects a U.S. physician shortage of as many as 43,100 primary care and up to 61,800 non-primary care doctors by 2030.

“There is a concern that the cost of medical school will deter otherwise qualified and underrepresented candidates,” said Fresne. “We’ve got to get to people younger, earlier; we’ve got to help them understand that they can afford a career in medicine.”

As Esianor put it, “The dark cloud of student debt always seems to linger close by.” Yet, he added, “My passion for medicine and desire to impact the lives of others ultimately provides me with peace of mind.”

Gretchen Bauermeister contributed to this article.